LHDN Customer Service: Lembaga Hasil Dalam Negeri Malaysia (LHDN), or the Inland Revenue Board of Malaysia, is the government agency responsible for administering and collecting taxes in Malaysia. LHDN plays a crucial role in ensuring the smooth functioning of the country’s tax system and providing excellent customer service to taxpayers. With a wide range of services and channels available, LHDN strives to make tax compliance convenient and hassle-free for individuals and businesses. This article provides an overview of LHDN’s customer service, including its address and website, as well as the various services offered to assist taxpayers.

Contents

LHDN Customer Service

Address: LHDN’s headquarters are located at the following address: Lembaga Hasil Dalam Negeri Malaysia Kompleks Bangunan Kerajaan Jalan Tuanku Abdul Halim 50600 Kuala Lumpur Malaysia

Website: https://www.hasil.gov.my/

1)Taxpayer Assistance: LHDN offers comprehensive assistance to taxpayers regarding tax-related queries, obligations, and filing procedures. Trained officers are available to address individual concerns through various channels, including phone calls, email, and walk-in appointments. These dedicated customer service agents strive to provide accurate and timely information, ensuring taxpayers have a clear understanding of their obligations and how to comply with tax regulations.

2)Taxpayer Education: Recognizing the importance of taxpayer education, LHDN conducts outreach programs and workshops to enhance taxpayers’ knowledge and understanding of tax matters. These initiatives aim to promote voluntary compliance, educate taxpayers about their rights and responsibilities, and provide insights into changes in tax legislation. Additionally, LHDN regularly updates its website with relevant tax guides, FAQs, and informative materials to assist taxpayers in fulfilling their obligations.

3)Online Services: LHDN has developed a user-friendly online portal that allows taxpayers to access a range of services conveniently. Through the website, taxpayers can perform tasks such as e-filing of tax returns, making tax payments, checking tax balances, and updating personal information. The online portal also provides access to a secure messaging system, enabling taxpayers to communicate directly with LHDN officers for specific inquiries or clarifications.

4)Mobile Application: To further enhance accessibility, LHDN has introduced a mobile application for smartphones and tablets. The app offers many of the same features available on the website, allowing taxpayers to manage their tax affairs on the go. With the mobile application, users can file tax returns, make payments, view assessment notices, and receive important notifications regarding tax matters.

5)Service Centers: LHDN operates service centers across Malaysia to provide in-person assistance to taxpayers. These centers are strategically located in major cities and towns, making it convenient for taxpayers to seek guidance and resolve tax-related issues. At the service centers, taxpayers can obtain personalized assistance, submit documents, and receive clarification on complex tax matters from LHDN officers.

6)Complaints and Feedback: LHDN values feedback from taxpayers and strives to continually improve its services. In case of any dissatisfaction or concerns, taxpayers can lodge complaints or provide feedback through various channels such as the LHDN website, phone calls, or written correspondence. LHDN ensures that all complaints are duly reviewed and appropriate actions are taken to address them promptly.

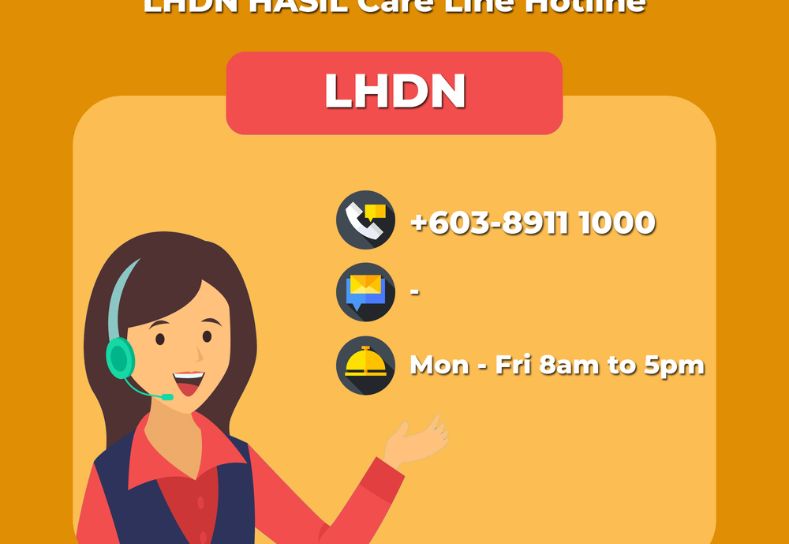

LHDN Customer Service Phone Number

Lembaga Hasil Dalam Negeri Malaysia (LHDN), also known as the Inland Revenue Board of Malaysia, is committed to providing excellent customer service to taxpayers. Recognizing the need for convenient and efficient communication, LHDN offers a dedicated phone helpline for taxpayers to seek assistance, clarify queries, and receive guidance on tax-related matters. This article provides an overview of LHDN’s customer service phone number, along with full details and the services available through this channel. LHDN Customer Service Phone Number: Taxpayers can reach LHDN’s customer service helpline by dialing the following phone number: Customer Service Phone Number: 1-800-88-5436

1)Availability and Operational Hours: LHDN’s customer service phone helpline is available during the following operational hours: Monday to Thursday: 8:00 AM to 5:00 PM Friday: 8:00 AM to 12:30 PM and 2:30 PM to 5:00 PM

2)Multilingual Support: The customer service helpline provides assistance in multiple languages to cater to the diverse population of taxpayers in Malaysia. English, Bahasa Malaysia, Mandarin, and Tamil are some of the languages supported by LHDN’s customer service agents. This multilingual support ensures that taxpayers can communicate their queries effectively and receive accurate guidance in their preferred language.

3)Services Offered: The customer service phone helpline offers a range of services to taxpayers, including:

a) General Inquiries: Taxpayers can seek information and clarification regarding tax regulations, filing requirements, deadlines, and other general tax-related matters.

b) Taxpayer Assistance: LHDN’s trained customer service agents can provide personalized assistance to taxpayers, addressing specific queries, and guiding them through tax processes and procedures.

c)E-Filing Support: Taxpayers who encounter issues or require guidance while e-filing their tax returns can seek assistance through the customer service helpline. The agents can help troubleshoot technical problems and provide step-by-step instructions to ensure a smooth e-filing experience.

d) Payment Inquiries: Taxpayers can inquire about payment methods, due dates, and any issues related to tax payments, including outstanding balances and installment plans.

e)Complaints and Feedback: The customer service helpline also serves as a channel for taxpayers to lodge complaints, provide feedback, or express concerns regarding their interactions with LHDN or any tax-related matters. LHDN ensures that all complaints and feedback are duly reviewed and appropriate actions are taken to address them.

4)Call Recording and Privacy: For quality assurance and training purposes, LHDN may record the calls made to the customer service helpline. These recordings help improve the service and ensure accurate information is provided to taxpayers. LHDN is committed to maintaining the privacy and confidentiality of all taxpayer information obtained through phone interactions, adhering to strict data protection guidelines and regulations.

How To Contact LHDN In Malaysia

Lembaga Hasil Dalam Negeri Malaysia (LHDN), also known as the Inland Revenue Board of Malaysia, provides various channels for taxpayers to contact them and seek assistance regarding tax-related matters. Recognizing the importance of accessible communication, LHDN offers multiple convenient methods for taxpayers to reach out and receive guidance, clarification, and support. This article provides an overview of the different channels available to contact LHDN in Malaysia, ensuring efficient communication and customer service.

1)Customer Service Phone Helpline: LHDN’s customer service helpline is an effective and convenient way to contact them. Taxpayers can dial the following phone number to reach LHDN’s customer service agents: Customer Service Phone Number: 1-800-88-5436

2)Online Enquiry Form: LHDN’s official website offers an online enquiry form where taxpayers can submit their queries and receive responses from LHDN officers. This method allows taxpayers to communicate their questions or concerns in a written format, providing a clear record of the interaction. The online enquiry form is accessible through the LHDN website.

3)Secure Messaging System: LHDN provides a secure messaging system through its online portal. Taxpayers can log in to their account and send messages directly to LHDN officers to seek assistance or clarification on specific tax matters. This channel ensures privacy and facilitates a direct and secure communication channel between taxpayers and LHDN.

4)Service Centers: LHDN operates service centers across Malaysia where taxpayers can seek in-person assistance. These service centers are located in major cities and towns, making it convenient for taxpayers to visit and address their tax-related queries. At the service centers, dedicated LHDN officers provide personalized assistance and guidance to taxpayers.

Conclusion: LHDN in Malaysia offers various channels for taxpayers to contact them and seek assistance with tax-related matters. The customer service phone helpline, online enquiry form, secure messaging system, service centers, and written correspondence options ensure that taxpayers have convenient access to LHDN’s support and guidance. By providing multiple communication channels, LHDN aims to facilitate efficient and effective interactions with taxpayers, ensuring a smooth tax administration process in Malaysia.